If you have any questions kindly comment below. The sequence for filling out parts and schedules However, the figures for total income / loss and tax payable be finally rounded off to the nearest multiple of 10 rupees. All figures should be rounded off to the nearest 1 rupee.Except as provided in the form, for a negative figure / figure of loss, write “-” before such figures.If any item is not applicable, write “NA” against that item.If any schedule is not applicable score across as “-NA-“.How to Fill ITR 3 and general instructions For transfer pricing, it is 30th November every year.For Audit cases, it is 30 September every year.In the case of individuals and HUFs who have salary income, House property, Capital gains, and business, and not in partnership business and/or eligible for filing ITR4 the due date is 31st July every year.The return may include income from House property, Salary / Pension, and Income from other sources.The persons having income from the following sources are eligible to file ITR 3 :

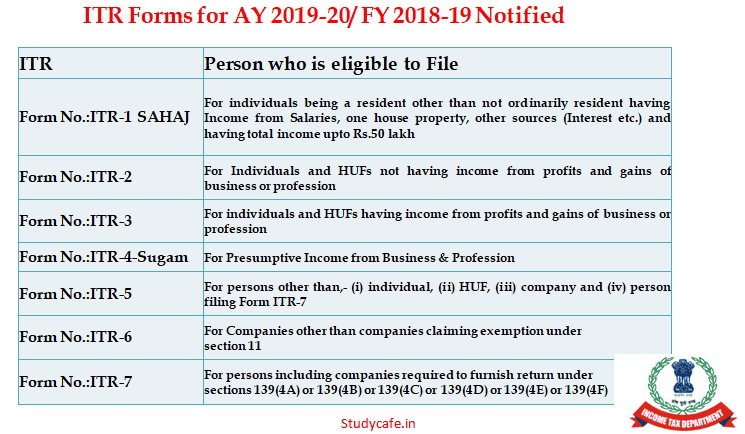

ITR-3 form applies to individuals and HUFs who have income from profits and gains from Proprietary business or profession. For audit cases, the last due date is 15th February 2021. The last date of income tax return filing for FY 2019-20 (AY 2020-21) is extended to 10th January 2021.

Step 3: Click ‘Income Tax Return’ available on the left hand side of the screen. Hello, in this post we will look into ITR-3 form. Step 2: On the right-hand side, you will find ‘Downloads’ tab.

0 kommentar(er)

0 kommentar(er)